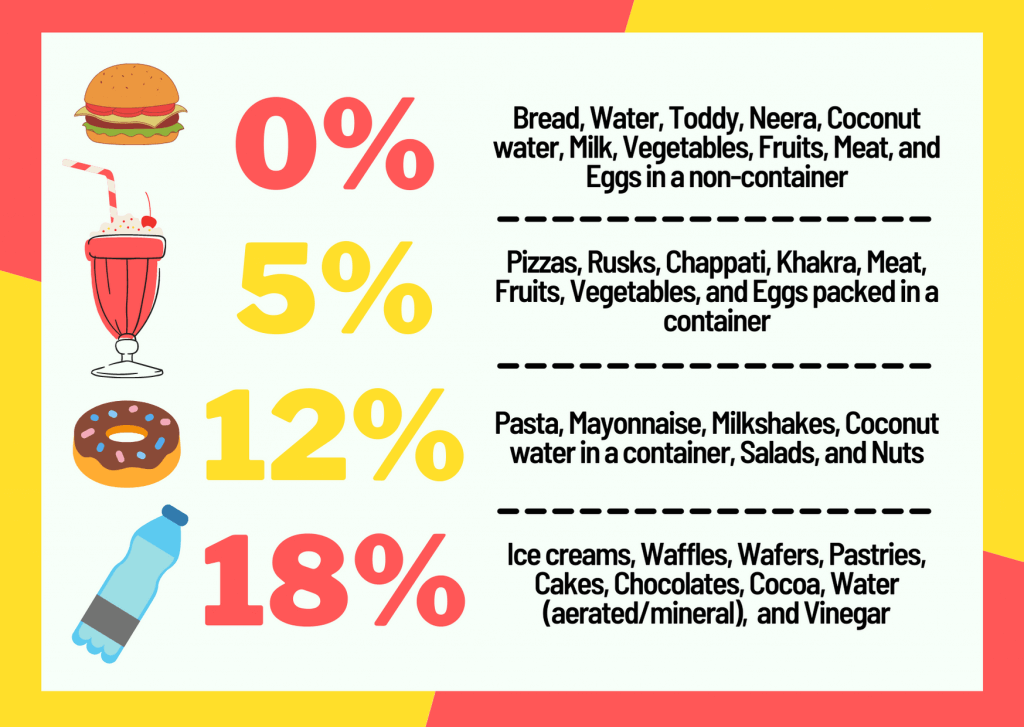

Gst Rate On Restaurant Food . gst on food and restaurants. Easily calculate gst with our gst calculator online. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — gst rates on restaurant foods. — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. — this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. The gst rate applicable to food and restaurant services is as follows: of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Ideal for all your gst. — circular no.

from www.caindelhiindia.com

— restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. — circular no. gst on food and restaurants. — gst rates on restaurant foods. The gst rate applicable to food and restaurant services is as follows: Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. Ideal for all your gst. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Easily calculate gst with our gst calculator online.

Applicable GST Rates for Restaurants Services IFCCL

Gst Rate On Restaurant Food Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. Easily calculate gst with our gst calculator online. Ideal for all your gst. gst on food and restaurants. — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. — this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. — gst rates on restaurant foods. The gst rate applicable to food and restaurant services is as follows: — circular no. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type.

From ebizfiling.com

A complete guide on GST rate on food items Gst Rate On Restaurant Food — circular no. — this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. — gst rates on restaurant foods. The gst rate applicable to food and restaurant services is as follows: gst on food and restaurants. Ideal for all your gst. of cooking and supply of. Gst Rate On Restaurant Food.

From www.deskera.com

GST on Food Services & Restaurant Business Gst Rate On Restaurant Food — circular no. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. — gst rates on restaurant foods. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — while some fresh and unprocessed food. Gst Rate On Restaurant Food.

From www.livemint.com

GST Council revises tax rates for 66 items Gst Rate On Restaurant Food of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Easily calculate gst with our gst calculator online. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. — gst rates on restaurant foods. Ideal for all your gst. The gst. Gst Rate On Restaurant Food.

From swaritadvisors.com

Applicability of GST on Food Industry Swaritadvisors Gst Rate On Restaurant Food gst on food and restaurants. — gst rates on restaurant foods. Easily calculate gst with our gst calculator online. — circular no. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — while some fresh and unprocessed food items are exempt, most packaged food products. Gst Rate On Restaurant Food.

From www.onlinelegalindia.com

Details About GST on Restaurant Services Gst Rate On Restaurant Food Easily calculate gst with our gst calculator online. — circular no. gst on food and restaurants. — this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. Ideal for all your gst. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as. Gst Rate On Restaurant Food.

From www.financialexpress.com

Papad vs Fryum Why do you end up paying more for some food items and Gst Rate On Restaurant Food — circular no. — gst rates on restaurant foods. Ideal for all your gst. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. — this article explains the impact. Gst Rate On Restaurant Food.

From vakilsearch.com

GST on Restaurant Food Roles, Rates, Impact, ITC, Taxation Gst Rate On Restaurant Food of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. — this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. —. Gst Rate On Restaurant Food.

From vakilsearch.com

GST on Restaurant Food Roles, Rates, Impact, ITC, Taxation Gst Rate On Restaurant Food Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. Easily calculate gst with our gst calculator online. — gst rates on restaurant foods. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. — circular no. of cooking and. Gst Rate On Restaurant Food.

From blog.saginfotech.com

GST AAR Applies 5 Tax on Food & Beverages Items Prepared in Restaurants Gst Rate On Restaurant Food The gst rate applicable to food and restaurant services is as follows: — circular no. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. — gst rates on restaurant foods.. Gst Rate On Restaurant Food.

From www.youtube.com

gst in hotel and restaurant rate gst in hotel and restaurant gst Gst Rate On Restaurant Food of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. The gst rate applicable to food and restaurant services is as follows: — circular no. — gst rates on restaurant foods. gst on food and restaurants. — restaurants are subject to either the 18% gst. Gst Rate On Restaurant Food.

From enterslice.com

Impact of GST on restaurant services An Overview Gst Rate On Restaurant Food — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. The gst rate applicable to food and restaurant services is as follows: Easily calculate gst with our gst calculator online. — circular no. — gst rates on restaurant foods. gst on food and restaurants.. Gst Rate On Restaurant Food.

From www.askbankifsccode.com

GST on Food and Restaurants Ask Bank Blog Gst Rate On Restaurant Food — circular no. — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. — this article explains the impact of gst on the restaurant and food industry, highlighting gst rates on food. Ideal for all your gst. gst on food and restaurants. Gst on. Gst Rate On Restaurant Food.

From vjmglobal.com

Applicable GST tax rates on Restaurants GST on restaurants Gst Rate On Restaurant Food gst on food and restaurants. — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. Easily calculate gst with our gst calculator online. Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — gst. Gst Rate On Restaurant Food.

From www.legalwindow.in

GST on Food Services & Restaurant Business in India Gst Rate On Restaurant Food Gst on food items in india can be 5%, 12%, or 18% based on factors such as the establishment type. — circular no. Easily calculate gst with our gst calculator online. — gst rates on restaurant foods. Ideal for all your gst. gst on food and restaurants. — this article explains the impact of gst on. Gst Rate On Restaurant Food.

From www.entertales.com

Decode GST In Your Bill And Check Whether You Are Overcharged By Gst Rate On Restaurant Food of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. — while some fresh and unprocessed food items are exempt, most packaged food products and. Gst Rate On Restaurant Food.

From cleartax.in

Impact of GST on Food Services & Restaurant Business Gst Rate On Restaurant Food gst on food and restaurants. Easily calculate gst with our gst calculator online. — restaurants are subject to either the 18% gst rate with itc claims or the 5% gst rate without the ability to. of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. Gst on. Gst Rate On Restaurant Food.

From cleartax.in

Impact of GST on Food Services & Restaurant Business Gst Rate On Restaurant Food of cooking and supply of food, by cloud kitchens/central kitchens are covered under „restaurant service‟, as defined in notification no. The gst rate applicable to food and restaurant services is as follows: — circular no. — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. — restaurants are subject to. Gst Rate On Restaurant Food.

From www.deskera.com

GST on Food Services & Restaurant Business Gst Rate On Restaurant Food — while some fresh and unprocessed food items are exempt, most packaged food products and restaurant. gst on food and restaurants. Ideal for all your gst. — gst rates on restaurant foods. The gst rate applicable to food and restaurant services is as follows: of cooking and supply of food, by cloud kitchens/central kitchens are covered. Gst Rate On Restaurant Food.